An investment’s future worth can easily be calculated in Excel by using the Future Value function, which is a financial function. The FV function can be used to calculate the future value of an investment under the assumption of the periodical cycle, consistent payments, and a rate of interest that remains unchanged during the investment’s lifespan. In this article, we are going to show you how to calculate the future value with inflation in Excel.

So, if you want to learn how to determine the future value of money in Microsoft Excel while considering the rate of inflation and want to know how to calculate the inflation-adjusted return on your investment, then you have just arrived at the correct location.

But before I begin to explain the calculations, I’d want to introduce you to a few terminologies, such as:

- Inflation

- Future value

- Nominal Interest Rate

- Real Rate of Return

These terms are going to help you understand the following calculations that we are going to show you. So, keep reading this post until the end to learn in detail.

What is Inflation, and How Does It Influence Our Daily Lives and The Economy?

Inflation is an economic word that refers to the gradual rise in the cost of goods and services over a period. Depending on who you talk to, inflation is seen as a symptom of a suffering economy, while others view it as an indication of a growing economy. When inflation is increasing, it means that you will have to spend more on the same products and services. Inflation may be beneficial in the source of income inflation as well as property inflation, such as in real estate or shares, provided you possess the assets before the prices increase.

However, if your salary does not keep up with inflation, your purchasing power will drop. Inflation raises the price of goods and services over time. When the rate of inflation is big enough, it has a negative impact on the economy.

On the other hand, inflation’s opposite is deflation, which is a contraction of the currency’s purchasing power. If we see deflation, prices will fall.

Deflation happened more often than inflation between the years 1920 and 1940 (20 years). From then, inflation took over as the dominant force. As a result, we find that the costs of most goods and services are increasing.

Assume you possess $100 in cash on hand right now. In addition, the expected inflation rate for the coming year is 4 percent. If you still have the money ($100), your purchasing power will be reduced to $96 after one year if you continue to hang onto the cash.

If we look at the whole cost of things, a $100 item will now cost $104 rather than $100. As a result, with your $100 in cash, you will be unable to purchase the identical thing that you were able to purchase one year earlier.

As a result, inflation cheapens the value of money while increasing the price of a thing. And that is why having cash on hand in the financial world is a terrible decision.

What is the Future Value of Money?

Time value of money is based on the simple idea that one dollar now is valued more than one dollar that you will get in the future and vice versa. Since you may deposit the dollar, you possess today and see it increase over time at a rate of return, also known as interest. And you won’t be able to invest the dollar you get tomorrow, and as a result, it will not have the same ability to grow in value.

Also, not that, amounts invested now will grow in future value over time, multiplied at a certain rate of interest; see the example below.

In the case of $1,000 invested today in a savings account earning a 2 percent annual rate of return, the money will be valued at $1,020 at the expiration of one year, according to the scenario above. As a result, it will be worth $1,020 in the future.

We can see what occurs after two years if we follow this path: One thousand dollars is transformed to 1044 dollars. You earned $20 the first year, but by the next year, you had earned $24 dollars. Why? After the first year has ended, the additional 4 dollars represents a 2 percent interest on a $20 profit.

Also, keep in mind that, the practice of generating interest on interest is referred to as compounding, and it has a significant impact on the future value of a financial asset.

When you invest your money in the case of a constant yearly return on your investment, we may determine the future worth of your money using the formula FV = PV(1+r)^n. In this equation, FV represents the future value, PV represents the present value, r represents the annual rate of return, and n represents the number of years.

If you make monthly deposits of a small amount of money, you may estimate your future worth by using the FV function in Microsoft Excel. In this article, we’ll go through both ways in detail.

What is the Nominal Interest Rate?

A bank will pay you interest upon your money if you put it in their hands and they keep it safe. The Nominal Interest Rate is the rate at which the bank lends you money in exchange for your interest. The nominal interest rate is 7 percent, for example, if your bank offers 7 percent per year in interest.

What Is the Real Rate of Return Calculation?

When the yearly percentage of profit is made on an asset and adjusted for inflation, that is referred to as the Real Rate of Return. The real rate of return, as a result, precisely reflects the actual buying power of a particular quantity of money over a certain period of time.

By changing the nominal return to account for inflation, an investor may evaluate how much of a nominal return is really a real return on his or her investment.

In addition to accounting for inflation, investors must take into account the influence of many other variables, which include taxes and investment fees, in order to determine actual returns on the money or to pick among alternative investment choices, such as mutual funds.

In order to compute the actual rate of return, you may use the simple formula provided below:

Real Rate of Return = Nominal Interest Rate – Inflation Rate

To calculate a Real Rate of Return, you must subtract the Inflation Rate from the Nominal Interest Rate or your yearly return.

How to Calculate Future Value With Inflation In Excel (Two Easy Methods)

At this point, now that you are here, I suppose you understood all the terminologies described above. So, now it’s time to learn how you can easily calculate the future value with inflation in Excel.

Scenario 1: Make a one-time investment with no regular deposits.

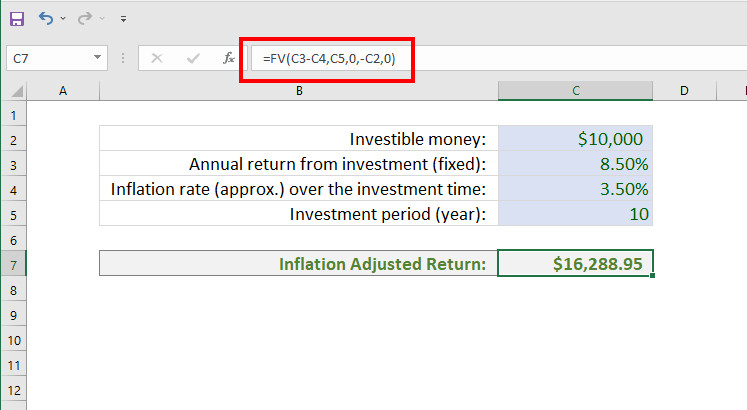

Consider the following scenario: You have some investable funds, and you would want to put the funds into an account with the following information:

- $10,000 is available for investment.

- 5 percent each year in yearly return on investment (assumed).

- Over the course of the investment period, the inflation rate was around 5 percent.

- The investment will last for a period of 10

So, What will your real return be after adjusting for inflation?

This is the amount of money you are going to receive in return, as you can see in the screenshot below.

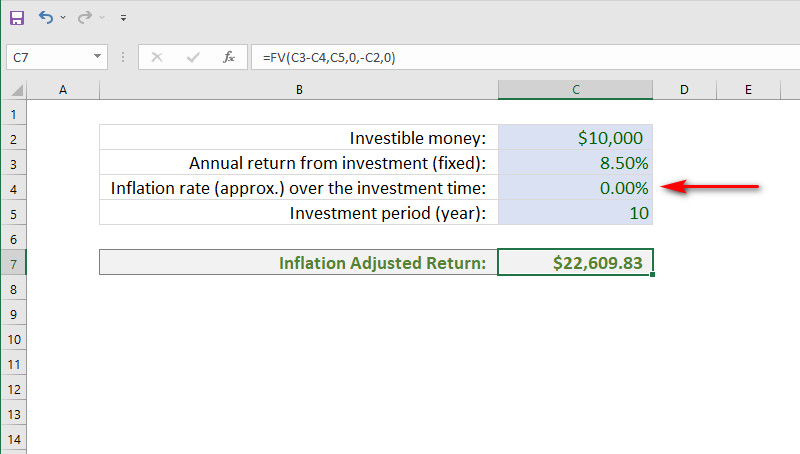

However, one thing should not be misunderstood. In actual situations, you will get a real return in the figure of $22,609.83 if you use the following calculation (assuming there is no inflation).

However, the buying power of your worth will be $16,288.05.

In addition, if you apply the below universal technique, you will get the same result as well. R will be calculated using the real rate of return that you can get by using this formula: Real Rate of Return = Annual Return – Inflation Rate.

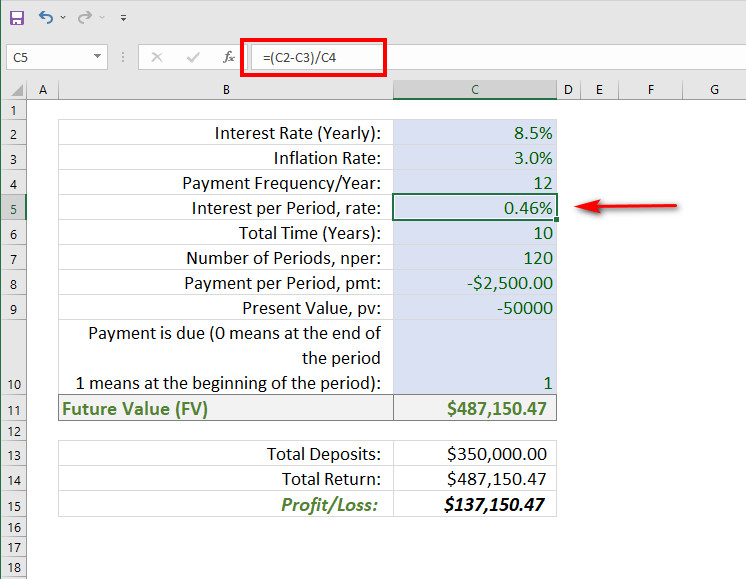

Scenario 2: Start a little initial investment and continue it with recurring deposits.

In this scenario, I’m going to walk you through a situation with the following specific details:

- $50 000 is the amount of your first investment.

- The amount of $2500 is paid on a monthly basis by you.

- A year-round interest rate of 5 percent is charged.

- 3 percent per year is the annual inflation rate.

- Payment Period/Year: 12 months

- 10 years is the total amount of time.

- Payable each period, in part (PMT): $2,500

- 50,000 is the present value.

- Generally, payment is made at the beginning of each period.

Here’s an example of the final result:

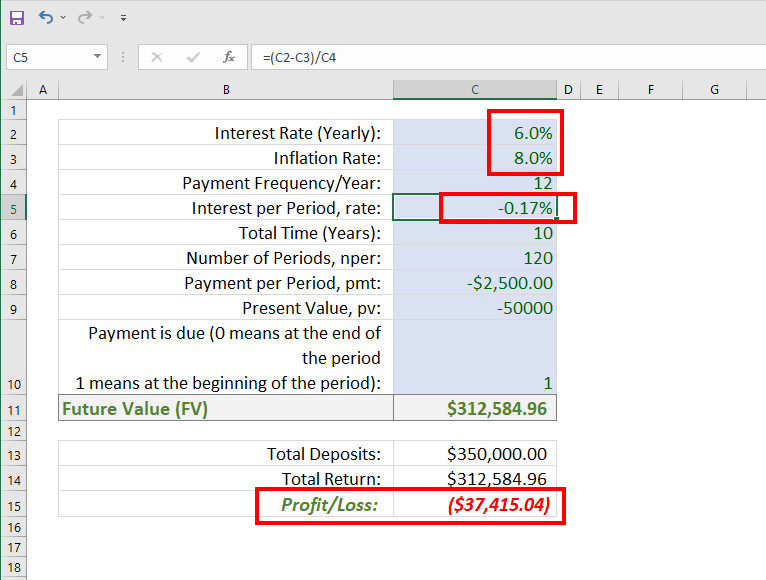

Did you notice how we have estimated the Interest per Period in cell C5? By deducting the Annual Inflation Rate from the Annual Interest Rate and then dividing the result by the number of payments made every year, we got the Interest per Period.

What happens if the annual return is less than the rate of inflation?

Now take a look at the screenshot below. You will really lose a lot of money if the yearly return is less than the inflation rate.

Conclusion

It’s critical to estimate the future return of your investment before you make it. However, if you are estimating it without taking into account the Inflation Rate, you are overlooking something extremely crucial. Even if you get an annual return of 10 percent on your investment in a country where the rate of inflation is 12 percent, you are essentially losing the purchasing power of your investment.

So, it’s important to calculate the future value with inflation. And you can easily do that in Excel. We hope, in this article, you find out how to calculate the future value with inflation in Excel.