Let’s say you are a small business owner who has just started a new journey of making money. You are responsible for paying your own taxes and have little experience with tax calculations. As time goes by, you want to ensure you stay on top of your tax obligations and avoid any potential legal or financial consequences.

In this scenario, creating a Self Employment Tax Calculator in an Excel Spreadsheet would be essential.

What’s the catch?

Well, you could use that spreadsheet to track your income and expenses, estimate your tax liability, and plan your finances accordingly. This would be helpful to avoid underpaying your taxes and facing penalties.

So, if you want a dynamic calculator to do this kind of easy job for you, then I’ve got you covered.

Keep Reading, As I’m about to automate your task. It just takes around 3 minutes of your valuable time. So, let’s get started.

What is Self Employment Tax?

Self Employment Tax is a tax that is paid by individuals who work for themselves, either as sole proprietors, partners, or members of an LLC. It is a combination of both Social Security and Medicare taxes, and is designed to ensure that self-employed individuals contribute to these programs just as employees and employers do.

Let’s look at a real-life example of my friends John and Jane. John is an employee at a large corporation, and his employer withholds Social Security and Medicare taxes from his paycheck. His employer also pays a matching amount of Social Security and Medicare taxes on John’s behalf.

On the other hand, Jane is a freelance graphic designer who works for herself. Since she is not an employee, there is no employer to withhold Social Security and Medicare taxes from her income. Instead, Jane is responsible for paying both the employer and employee portions of these taxes herself, which is referred to as Self Employment Tax.

This means that while John’s employer pays half of his Social Security and Medicare taxes, Jane is responsible for paying the full amount of Self Employment Tax on her net earnings as a self-employed individual.

It’s a common question, Who Needs to Pay the Self Employment Tax?

Well, If you are self-employed and your net earnings are $400 or more for the year, you are generally required to pay Self Employment Tax.

Net earnings are calculated by subtracting business expenses from business income. This means that if you are self-employed and your business income exceeds $400 after deducting eligible expenses, you will probably owe Self Employment Tax.

Here’s a quick information:

As of 2023, the Self Employment Tax rate is 15.3% of net earnings, with 12.4% going to Social Security and 2.9% going to Medicare. However, only the first $142,800 of net earnings is subject to the Social Security portion of the tax. Once the net earnings exceed this amount, the Social Security portion of the Self Employment Tax will no longer apply.

The general formula of self-employment tax is:

Net Earnings x 0.153

For example, if a self-employed individual has net earnings of $50,000 for the year, the calculation for Self Employment Tax would be:

$50,000 x 0.153 = $7,650

Therefore, the Self Employment Tax owed would be $7,650 for the year.

How To Calculate Self-Employment Tax in Excel

Parts of being a successful business owner are knowing the ins and outs of your taxes!

Even if you are taking help from your friends or hiring someone to calculate the taxes for you, it’s important to know how to calculate it yourself.

Here are the steps to create a self-employment tax calculator in Excel Spreadsheet:

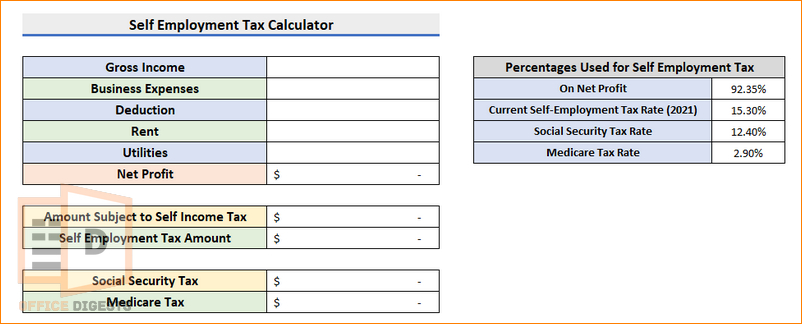

1. Establish a Dataset For Net Profit and Percentages

First things first. You must organize your dataset. Go through your bank account, check all the amounts you are getting in your account and then establish datasets for net profit and percentages.

Note: To create a dataset for net profit, you must have clear ideas about Gross Income, Business Expenses, Deduction, Rent, and Utilities.

Look at the image above. First, you need to calculate your net profit. Using that net profit, you need to calculate the amount subject to self income tax. Follow the next step after gathering all your data.

2. Calculate The Net Profit Amount

To calculate the net profit you need to subtract Gross income with all other business expenses. You can either do it with Excel functions or you can enter formulas without using functions. Suppose my gross income is $30,000 and my business expenses, rent, utility costs are $4000, $1000, and $3000 respectively.

So my net profit amount will be-

If you are confused about how to add and subtract values in excel in one formula then you should read the definitive guide before moving forward.

3. Determine The Amount Subject to Self-Income Tax

Here, 92.35% is the percentage that indicates the amount subject to the income tax. Except that, As of 2023, the Self Employment Tax rate is 15.3% of net earnings, with 12.4% going to Social Security and 2.9% going to Medicare.

Now multiply the net profit by 92.35% and you will get the amount subject to self income tax.

4. Find The Self Employment Tax Amount

For finding the exact amount of self-employment tax, you need to multiply the amount subject to self-income tax with 15.3%, which is the self employment tax rate.

5. Calculate Social Security and Medicare Tax

If you want to calculate how much the social security and medicare tax is from the total individual tax amount, you need to multiply the total amount with 12.4% to get the social security tax amount. And Multiply the total employment tax with 2.9% to get the Medicare Tax amount.

It’s worth noting that the tax rate changes. As of 2023, the self-employment tax rate didn’t change. But it can change depending on the country’s financial ability.

FAQ

Question: What is the total self-employment tax rate?

Answer: 15.3% is the total self-employment tax rate as of 2023. The rate may vary. The SE tax rate is divided into two parts. 12.4% for social security and 2.9% for medicare.

Question: What is the difference between income tax and self-employment tax?

Answer: Income tax is a tax on income, while self-employment tax is a tax on self-employment income. While income tax is paid by all individuals and businesses that earn income, self-employment tax is paid only by individuals who work for themselves.

Final Words

Calculating self-employment taxes can be a time-consuming process, but using a calculator in Excel can make the process much more efficient. The automated calculator can help you to quickly and easily estimate your tax liability, so you can focus on running your business smoothly.