Although there are so many templates out there, nothing seems to be engaging enough. You might want more or less depending on your financial condition.

The best way to deal with this situation is creating your personal expense tracker.

Instead of merely logging expenses, imagine using your expense report as a reflection of your values and priorities.

That said,

In this post, we will show you how to create a personal expense report in Excel in a step-by-step pattern.

How To Create an Expense Report in Excel

Expenses are not just necessary for personal use only. You can create a report based on your business finances too.

Yes, there are free templates to begin with. But, it’s recommended to create your own. Because, only you know about the type of information you should include on your report.

Here are the steps to create a simple expense report in Excel:

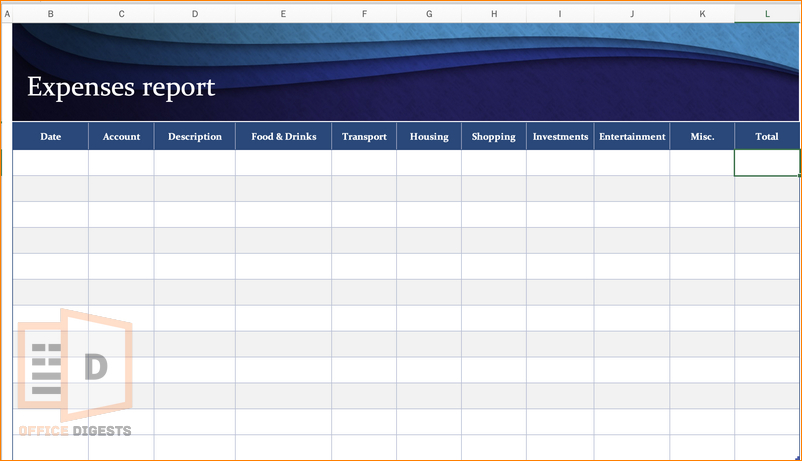

1. Create Necessary Column Headers

Typically, an expense report includes columns such as Date, Category, Description, Amount, and Notes. You can add additional columns as per your specific needs.

I like to separate my expense categories based on food & Drinks, shopping, housing, investments, Transportation, and life & Entertainment.

Quick Tip: Spare a column for Miscellaneous expenses. This will help you keep track of your money that went off track.

2. Convert The Data into a Table

Select the whole dataset and go to the Insert Tab. Select the Table Option and Click on “My Table has headers”. This will convert the dataset into a table.

You can also make your table look good by adding certain elements to it.

So, what will happen if you insert a table instead of a normal data entry?

Well, this will create a dropdown list for all the column headers added to your worksheet. So, whenever you fill up the template, you can easily sort the expense category.

3. Apply Suitable Data Format

Not all the provided categories will have the same format. You cannot merge the Date format with the text format. That’s why it is important to provide a suitable data format to each column.

I recommend using the Ctrl+1 shortcut.

Click on the column header you want to format. Press Ctrl+1 and select the appropriate one.

I like to keep the date format as Day, Date-Month, Year (Saturday, 13 May, 2023).

4. Add Necessary Formulas

In this step, you have two options. Either use the built-in functions to create a formula. Or, you can enter a formula without using a function.

Basically, in this report, you need only one function and that is the SUM function. Select the Total expense column and type =SUM. Drag the rows you want to add. Similarly, to get the summation of the overall month, use the SUM function one more time.

Alternatively, you can use Conditional Formatting to highlight certain values or apply color-coding based on specific conditions.

PRO TIP: Highlight the highly expenditure column with a color. This will ensure if you are over-budget or not. Use the SUM Function to add cells based on color.

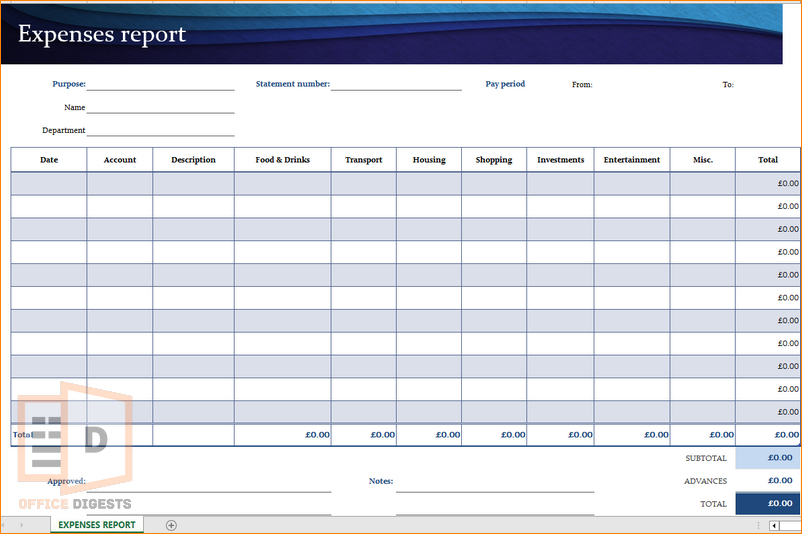

5. Add Finishing Touches To Your Report

This step is optional. You can start populating your report with the necessary data right away.

However, when you establish a system and maintain order in your surroundings, tasks become easier to manage.

Information becomes readily accessible, and you can focus on what truly matters.

So, adding final touches means adding necessary fields to your report. You can remove grid lines, insert checkboxes if you want.

Depending on the complexity of your expense report, you should include a summary section that calculates totals or provides additional insights.

For example, you could calculate the total expenses by category, or the overall total spent.

6. Review and Analyze the Expense Report

Once you have entered all the necessary expenses, it’s time to review the report to gain insights into your spending patterns.

You can identify areas where you may need to cut back or allocate more resources.

Remember to update and maintain your expense report regularly by adding new expenses and adjusting totals as needed. This will allow you to keep track of your spending and make informed financial decisions.

With these six simple steps, you can easily create an expense report template. Now that you created one, you can sell these templates online to get some extra cash flowing to your bank account.

Things To Keep in Mind

In the world of expense reports, there is a hidden gem waiting to be discovered—mindful spending.

While expense reports are often seen as mundane tasks focused solely on tracking numbers, they can actually become powerful tools for cultivating a mindful approach to spending.

Take a moment to pause and contemplate each expense before recording it.

Ask yourself: Does this expense align with my goals? Does it bring value and joy to my life? By consciously evaluating your spending choices, you can transform your expense report into a roadmap of mindful financial decisions.

It’s important to maintain a consistent flow while recording your expenses. It’s easy to forget. In such scenarios, follow some tricks-

- Seek Supporting Documentation: While you may not have a comprehensive record, try to gather any supporting documents you can find.

Take a thorough look at your bank and credit card statements, as well as any digital payment platforms you use.

Look for transaction records within the relevant time period and identify expenses you can recall. Note down the date, vendor name, description, and amount for each transaction. - Use digital tools and apps: Initially, connect your digital apps to your bank account. So, whenever you are doing any transactions, you will get a receipt. Trust me, it helps a lot if you want to rebound your expenses and keep it on track.

- Keep a Space for Authorization: An authorized signature space is a must for verifying that the document is validated.

FAQ

Q: What is an expense report?

A: Expense reports are documents that summarize and itemize the expenses incurred by an individual or a business during a specific period. You can use this report to keep track of your daily expenses to get a detailed overview.

Q: Does Excel have an expense report template?

A: Yes, Excel has several expense report templates to track your day-to-day budgets. Not only that, you can also add a custom dashboard to your dataset to get a full view of the expense analytics.

Conclusion

Expense reports come in handy in professional life. If you are an HR of a company, then this type of templates help narrow the timeframe of your busy schedule.

With our template, you can easily input the necessary data for your company or personal use.